2020 Tax Obligation Calculator

An iTax e-Return Acknowledgement receipt will be generated Download the e-Return Acknowledge slip for your records. View a list of what youll need to get started.

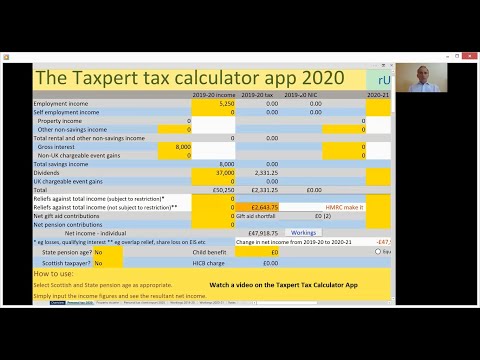

Ultimate Corporation Tax Calculator 2021

These rates come into effect at the start of the new tax year on April 6th 2020.

2020 tax obligation calculator. Extension and expansion of credit for qualified sick and family leave wages. Form OR-40 for full-year Oregon. As an employer you have a tax obligation to deduct employees tax in the form of PAYE Pay as you Earn from any remuneration paid to employees and settle this amount with SARS on a monthly basis.

The COVID-related Tax Relief Act of 2020 extended the period during which individuals can claim these credits. This calculator will help you estimate your 2020 federal income tax obligation and give you a rough idea of whether you can expect a refund this year. Under Tax Obligation select Income Tax PAYE from drop down menu.

The American Rescue Plan Act of 2021 the ARP enacted on March 11 2021 provides that certain. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. Enter the return period eg 01012022 to 31122022 and click Submit.

This tax benefit will be available from 1st April 2020 AY 2020-21 and till the end of the home loan tenure closure. Federal income tax withheld from your 2020 RRB NSSEB tier 2 VDB and supplemental annuity payments by adding the amounts in box 9 of all original 2020 Forms RRB. Currently there are two standard methods for calculating PAYE namely.

Worried student loans will take your 2020 tax refund. There will be detailed information on how to claim your credit in the 2021 Oregon personal income tax return instructions. For more information see the Instructions for Form 7202 and Schedule 3 Form 1040 line 13b.

If you are a nonresident alien and your tax withholding rate andor country of legal residence changed during 2020 you will receive more than one Form RRB-1099-R for 2020. Short-term capital gains. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

Even if you dont have a filing obligation for 2021 you still must file a 2021 tax return to claim your credit. You have 65 days after getting a student loan tax garnishment notice is sent to dispute it. Determine the total amount of US.

Tue 03 Mar 2020. Civil Servants Job Groups Salaries and Allowances. The total interest deduction is.

UK PAYE Tax Rates and Allowances 202021 This page contains all of the personal income tax changes which were published on the govuk site on Fri 28 Feb 2020. In this blog article we will focus on the steps you will need to follow to calculate PAYE. Federal Income Tax Calculator for 2020.

Youre eligible to claim the kicker if you filed a 2020 tax return and had tax due before credits.

Dividend Tax Calculator 2021 22 Tax Year It Contracting

Contractor Vs Paye Day Rate Calculator Grampian

Excel Formula Income Tax Bracket Calculation Exceljet

New Tax Regime Tax Slabs Income Tax Income Tax

![]()

Salary And Tax Deductions Calculator The Accountancy Partnership

Dividend Tax Calculator 2020 21 Tax Year It Contracting

Tax Calculators Uk Tax Calculators

Dividend Tax Calculator Taxscouts

Existing Tax Regime Tax Slabs Income Tax Tax Income

Income Tax Calculator Taxscouts

Advisers Must Understand How To Calculate Top Slicing Relief Ftadviser Com

Rental Income Tax Calculator Taxscouts

Pin On Tax Services In Tucson Arizona

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions Tax Deductions List

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Comments

Post a Comment