2020 Standard Deduction Mn

Are the IRS economic impact payments included in household income for the Minnesota Property Tax Refund. 1 Amended 2020 c 115 art 3 s 26.

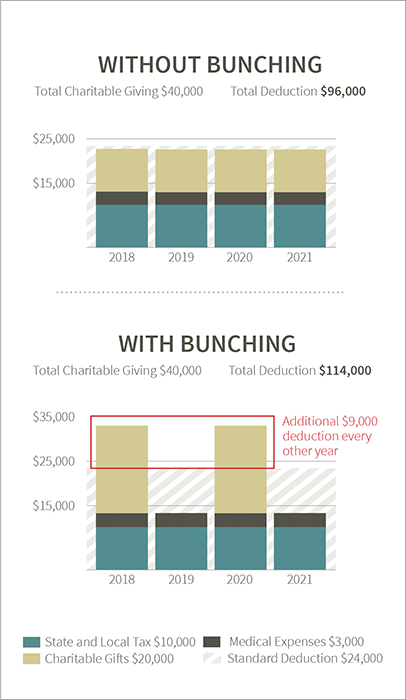

Why So Many Financial Advisors Recommend Charitable Bunching Catholic Community Foundation

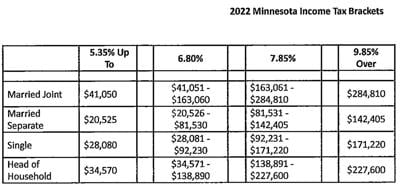

This annual adjustment will prevent taxpayers from paying taxes at a higher rate solely because of inflationary changes in their income.

2020 standard deduction mn. Viewing General Employee Data MN PS102S. - The Minnesota Department of Revenue announced the adjusted 2021 individual income tax brackets. Viewing Employee Job Data MN PS101S.

15 to file taxes IR-2020-150 IRS gives tips on filing paying electronically and checking refunds online. A bill to provide emergency assistance and health care response for individuals families and businesses affected by. For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law.

For tax year 2021 the states individual income tax brackets will change by 1001 percent from tax year 2020. Appropriation base is defined in MS. File and pay 2019 business taxes by July 15.

Text for S3548 - 116th Congress 2019-2020. The agency budgets are based on the November 2020 Budget and Economic Forecast released on December 3 2020 and are the basis or starting point for the Governors biennial budget recommendations that will be released by January 26 2021. 2020 estimated tax also due IR-2020-153 IRS reminder.

Has COVID-19 affected the turnaround on substitute forms and electronic filing certification. 12 Amended 2020 c 115 art 4 s 115. Vendor Deduction Detail and Report Information MN PS520S.

2019 tax returns and payments due July 15 IR-2020-148 IRS provides last-minute tips for last. SWISWIFT Update April 1 2021 SWIFT Update April. 5l Amended 2020 c 2 art 5 s 38.

Taxes in SEMA4 MN PS360S. 13 Amended 2020 c 115 art 4 s 116. Proposition 116 adopted by Colorado voters in November 2020 resulted in the permanent reduction of Colorados flat individual and corporate income tax rates from 463 to 455 percent retroactive to the beginning of tax year 20205.

5m Amended 2020 c 2 art 2 s 12. Taxpayers can get an extension to Oct. Deduction for taxpayers with income of more than 79300 but less than or equal to 84600.

Legislative-Citizen Commission on MN Resources LCCMR Legislative Commission on Pensions Retirement LCPR. These payments are considered a federal tax credit. The standard deduction which Minnesota has is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deductionEssentially it translates to 650000 per year of tax-free income for single Minnesota taxpayers and.

State Income Tax Standard Deductions Tax Policy Center

Mn Standard Deduction Correction Olsen Thielen Cpas Advisors

Minnesota Income Tax Brackets For 2020 Released Mendota Heights Mn Patch

State Of Mn Corrects Standard Deduction Instructions

Minnesota State Tax Refund Mn State Tax Brackets Taxact Blog

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 Krox

State Of Mn Corrects Standard Deduction Instructions

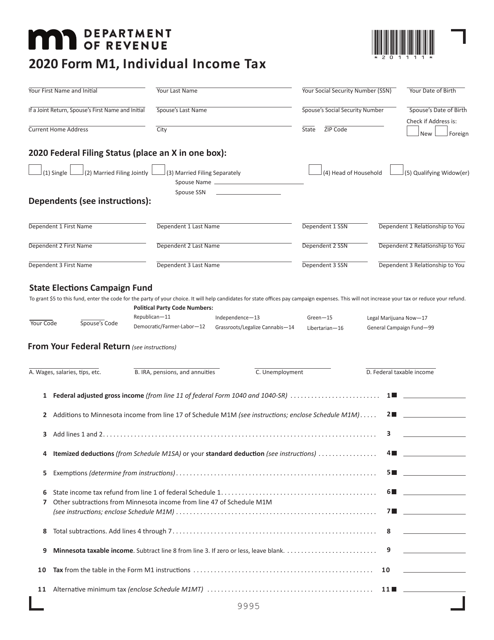

Form M1 Download Fillable Pdf Or Fill Online Individual Income Tax 2020 Minnesota Templateroller

State Of Mn Corrects Standard Deduction Instructions

Minnesota Income Tax Brackets For 2020 Released Mendota Heights Mn Patch

Minnesota State Income Tax Mn Tax Calculator Community Tax

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Taxation Of Social Security Benefits Mn House Research

Mn Dor M1 2020 2022 Fill Out Tax Template Online Us Legal Forms

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Comments

Post a Comment