2020 Standard Deduction Vs Itemized

For 2021 the standard deduction numbers to beat are. Standard Deduction vs.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

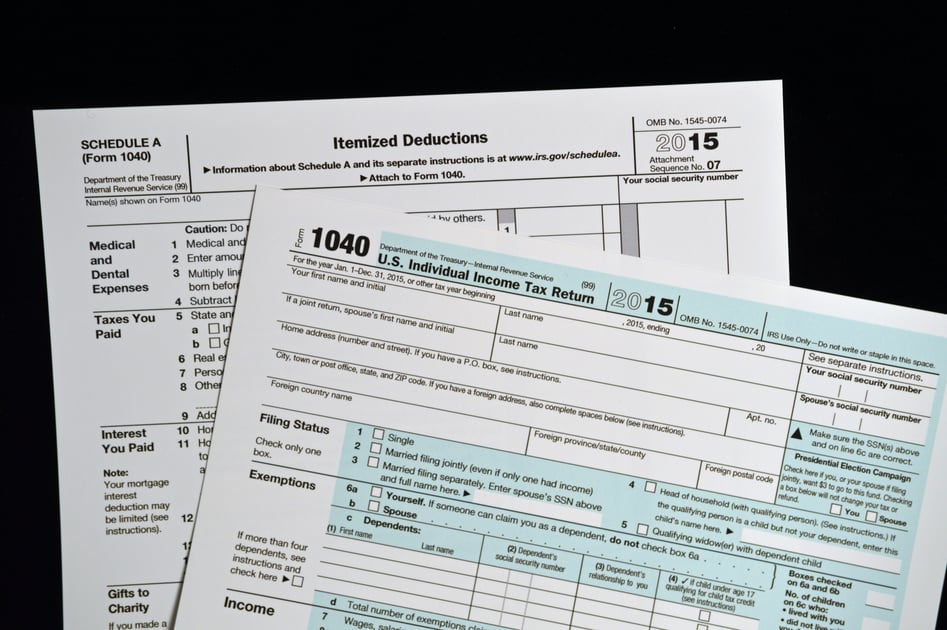

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

The Tax Cuts and Jobs Act TCJA passed in December 2017 made several significant changes that impacted homeowners beginning with a massive increase in the standard deduction available to all taxpayers.

2020 standard deduction vs itemized. The bottom line is that the medical expense deduction is once again taxpayer-friendly but numerous rules apply to what you can deduct and when. The difference between the standard deduction and an itemized deduction is simple. Heres how it works and when to take it.

For single taxpayers and married individuals filing separately the standard deduction rises to 12400 in for 2020 up 200 and for heads of households the standard deduction will be 18650 for tax year 2020 up 300. Depending on your tax-filing. The standard deduction for the 2021 tax year is.

In 2016 the standard deduction was 6300 for single filers and 12600 for married. Then in December 2020 further legislation made the 75 threshold permanent. Claiming Standard Deductions vs.

A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. The standard deduction is adjusted annually for inflation and the limits are based on your filing status. After subtracting the standard deduction of 24400 your taxable income for 2020 is 65600.

The standard deduction nearly doubled as a result of the Tax Cuts and Jobs Act which went into effect in 2018. The standard deduction for married filing jointly rises to 24800 for tax year 2020 up 400 from the prior year. If you are single or married filing separately the deduction is 12550.

To compensate for the loss of personal exemptions the standard deduction was nearly doubled for the 2018 tax year and it was again adjusted upward for 2019 and 2020. Following the tax law changes per the Coronavirus Aid Relief and Economic Security Act cash donations of up to 300 made in 2020 were. That means you would have to sit down review your financial documents and.

It is now 12400. For tax year 2021 which generally applies to tax returns filed in 2022 the amounts have increased as follows. In 2021 the standard deduction is 12550 for singles 25100 for joint filers and 18800 for heads of household.

The standard deduction for taxpayers who dont itemize their deductions on Schedule A of Form 1040 or 1040-SR is higher for 2021 than it was for 2020. 12550 for single filers and married individuals filing separately up. If you can be claimed as a dependent on someone elses tax return your standard deduction for 2020 is limited to the greater of 1100 or your earned income plus 350 up to the amount of the.

Those are the numbers for most people but some get even. The amount depends on your filing status. Even if you utilize the standard deduction all is not lost.

The former is a specific or standard number determined solely by your age and filing status. Say youre married filing jointly with a gross income of 90000 in 2020. IRS Publication 600.

If you are married filing jointly or are a qualifying widower the deduction is 25100. But the latter requires you to manually itemize your deductions. 25100 for married couples filing jointly up 300 from the 2020 tax year.

Married taxpayers filing a joint return. The personal exemption for tax. The deduction was subject to a 75 threshold through the end of 2020 the tax return you filed in 2021.

The Effects of Federal Legislation. That might sound like a lot of work but it can pay off if your total itemized deductions are higher than the standard deduction. You can use the 2021 Standard Deduction Tables near the end of this publication to figure your standard deduction.

For 2020 the standard deduction went up once again for everybody. That puts you in the 12. IRS Publication 600 was.

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

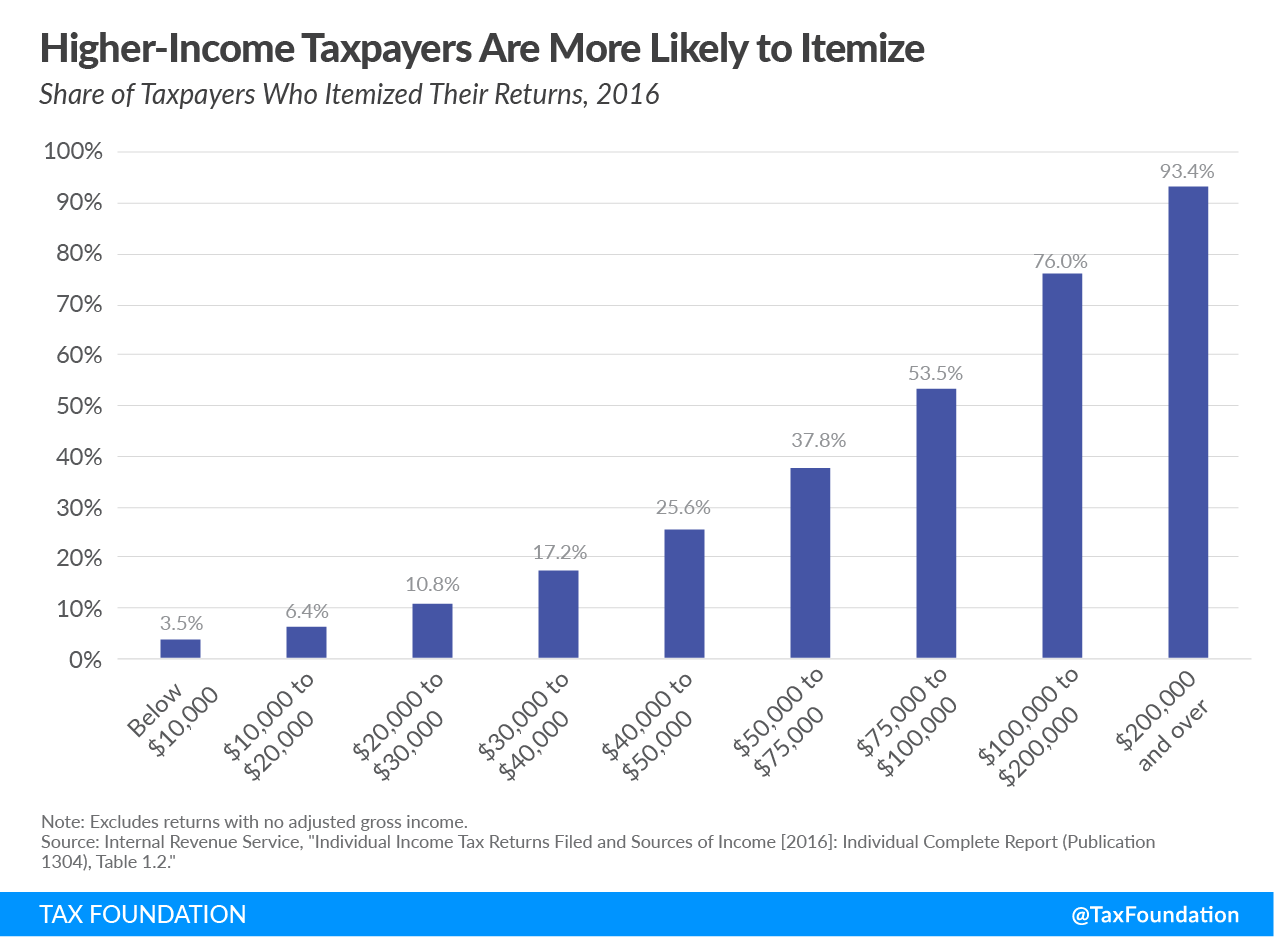

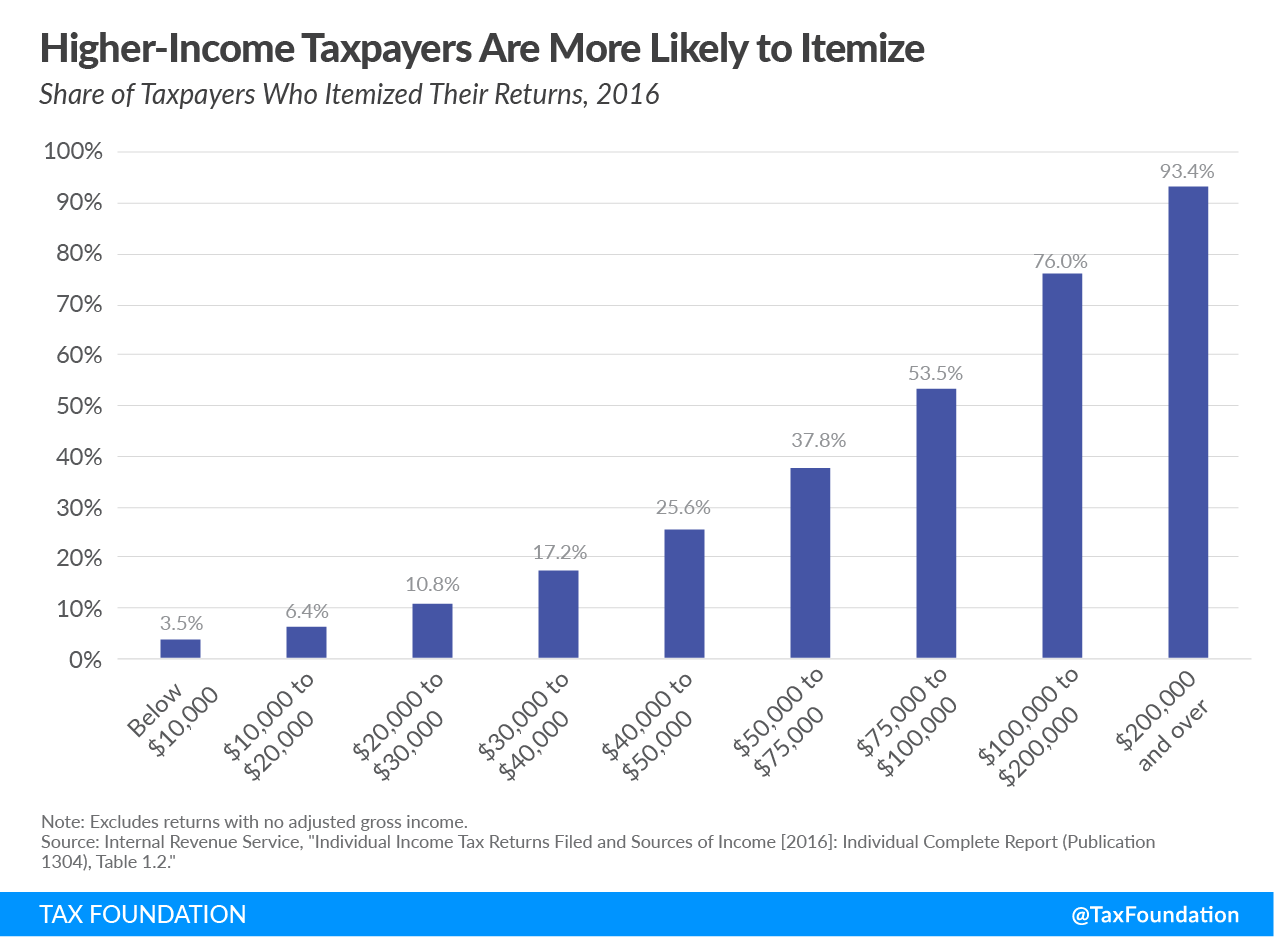

Itemized Deduction Who Benefits From Itemized Deductions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Before Completing Your 2020 Tax Return Keep These 5 Filing Tips In Mind Beirne Wealth Consulting Services Llc

Nearly 8 In 10 Taxpayers Will Make This Move In 2020 The Motley Fool

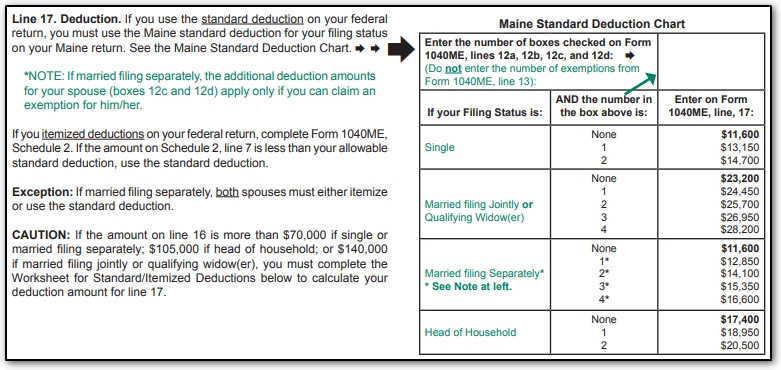

Me Standard Or Itemized Deduction Changes

The Change In The Standard Deduction Affects Charitable Giving Clark Nuber Ps

The Standard Deduction Vs Itemizing Your Tax Return Which Is Best Youtube

Most Commonly Used Tax Deductions For 2020 And 2021 Financial Finesse

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Standard Vs Itemized Deductions

Standard Deduction Or Itemized Which Is Better For You In 2018 Brio Financial Planning

Difference Between Standard Deduction And Itemized Deduction H R Block

Taxes The Standard Deduction Or Itemized

Comments

Post a Comment