2020 Tax Deferral Calculator

Form 700 estate and generation skipping tax 2013-2020 Decedents Estate Tax Calculator Notice regarding extensions granted under IRS Notice 2020-23 in response to COVID-19. What costs can I claim when working from home.

Fca Mortgage Holidays Extended To July 2021

Land held on trust up to 2019-20 Minor interests.

2020 tax deferral calculator. Included is the M O CPE Individual Tax Year-End Workshop Reference E-Book annually written by Vincent J. Credit Card Help for. The age of eligibility for OAS will gradually increase from age 65 to age 67 Note this change was subsequently revoked by the Liberal government prior to implementation.

How is land tax assessed. How Biden. Deferral of Employment Tax Deposits and Payments.

This is designed for use by a self-employed person in order to calculate how much to claim as a tax. Form 700 estate and. This affidavit will not be accepted unless all areas on all pages are fully and accurately completed.

For more information see the Instructions for Form 7202 and Schedule 3 Form 1040 line 13b. Important information for NYC residents with taxable income over 500000. And if you are 50 or older the catch-up contribution is an additional 6500.

You will be able to defer taking your OAS. 2021-22 Trust Land Tax Rate Calculator. President Trump issued an executive order to defer the payment of payroll tax between September 1 2020 and December 31 2020.

It is important to note that the above numbers dont include the catch-up for people age 50 and. The 2020 Solo 401k contribution limits are 57000 and 63500 if age 50 or older 2019 limits are 56000 and 62000 if age 50 or older. The annual Solo 401k contribution consists of 2 parts a salary deferral contribution and a profit sharing contribution.

MOCPE the definitive tax seminar Our annual workshop is the best way to prepare for tax season. 6000 for traditional and Roth IRAs. Please type or print.

Underpayment of Estimated Income Tax By Individuals and Fiduciaries for tax year 2020. Real Estate Excise Tax Affidavit RCW 8245 WAC 458-61A Only for sales in a single location code on or after January 1 2020. Arizona RASL Notification Form - Nationwidepdf.

Taxes are calculated based on a 12 month period regardless of occupancy date and do not include in-year adjustments resulting from supplementary omitted or appeal activity. How do I calculate my claim. OBrien CPA and used by practitioners all year long.

Section 2302 of the CARES Act permits self-employed individuals to defer payment of a portion of their 2020 self-employment tax until 2021 and 2022. Current tax rates. Calculate Land Tax Calculate Land Tax Menu.

The COVID-related Tax Relief Act of 2020 extended the period during which individuals can claim these credits. Extension and expansion of credit for qualified sick and family leave wages. So you can save a total of 26000.

In an IRS COVID Tax Tip dated July 6 2021 the IRS reminded taxpayers that if they deferred a portion of their Social Security taxes in 2020 the first installment of the re-payment is due in December 2021. Although Congress may pass further action to waive some or all of these deferred taxes nothing has been passed. Practical Suggestion for Tax Refund.

Is It Worth It. 27 July 2021 This is a freeview At a glance guide to use of home as an office claims. As stated in the RASL literature please.

Use of home as an office. Use our Property Tax Calculator to view your annual tax levy and to see the breakdown of where your tax dollars go. 2021-22 General Land Tax Rates Calculator.

As part of the 2020 Budget Chancellor Rishi Sunak announced that the National Insurance Contribution NIC thresholds for the 2020-21 tax year will rise. Tax Season Countdown All Over Again June 30 2020. Review our current and past tax rates.

He is proud to be one of only nine Tax AssessorCollectors in the State of Texas that has earned the designation of CTA Certified Tax Administrator. Here tax deferral no Roth is a scenario similar to capital gains paying taxes only when you sell the stock. Document Title Last Updated.

Capital gains tax discount - If you decide to sell your investment property and make a capital gain on the transaction you are required to pay tax on the profit. Deferring payment for either the July or. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022.

But if the property is under your ownership for more than a year. Nationwide RASL Deferral Notification Form. Land held on trust Land held on trust Menu.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on. IT-2106 Fill-in IT-2106-I Instructions Fiduciaries. Specifically the payment of 50 of the social security tax imposed on net earnings from self-employment earned during the period beginning on.

Refunds of 2 months of paid payroll tax. Larry Gaddes is a sixth generation Texan that served Williamson County residents for over ten years before taking office as the Williamson County Tax AssessorCollector in January of 2017. At this time the payroll tax obligation will remain in full but the due date for payment of that tax obligation has been.

19500 for elective-deferral contributions to 401ks 403bs 457s as well as Thrift Savings Plans. Two extra digits for the tax year eg. Normally the IRS will increase the deferral 500 every year or every other year.

A payroll tax holiday for 3 months. Deferring payment for March - December 2020 returns. These 11 year-end tax tips for retirement will help you minimize your 2021 taxes and reduce future tax bills.

If your property is purchased and sold within 12 months your net capital gain is added to your taxable income which also increases the amount of income tax you pay. The relief has ended and is no longer available. Updated with 2020 rates.

Estate Tax Instruction Sheet for 2020 Decedents. The total allowable contribution adds these 2 parts together to get to the maximum Solo 401k contribution limit. Self-employed National Insurance threshold rise.

Inside build-up taxed is like. What restrictions should I apply. Taught by renowned lecturer and CPA firm CEO Vincent J.

The total allowed contribution usually goes up 1000 based on inflation. Section 2302 of the CARES Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040 for tax year 2020 over the next two years. Estimated Income Tax Payment Voucher for Fiduciaries - Payments due April 15 June 15 September 15 2020 and January 15 2021.

Both employed workers and self-employed workers who pay Class 4 contributions will be able to earn up to 9500 in 2020-21 up from 8632 in 2019-20 before. Check box if partial sale indicate sold. Estate Tax Instruction Sheet for 2019 Decedents.

As part of the 2012 federal budget the government announced three changes to Old Age Security OASprogram. 2013-2021 Decedents Estate Tax Calculator 2020 Decedents. 2020-21 land tax changes.

21 for 2020 to 2021 22 for 2021 to 2022 two extra digits for the month eg. In 2020 and 2021 payroll tax relief measures were available to eligible businesses to alleviate the impact of coronavirus COVID-19. 01 for month 1 from 6 April to 5 May.

This form is your receipt when stamped by cashier. The relief measures included. The American Rescue Plan Act of 2021 the ARP enacted on March 11 2021 provides that certain.

Pay off Credit Card Debt.

Should You Defer Your State Pension Which News

Ir35 Changes Postponed Bdj In Practice

Covid 19 Deferring 31 July 2020 Payments On Account

February Tax Newsletter Video In 2021 Financial Planning Tax

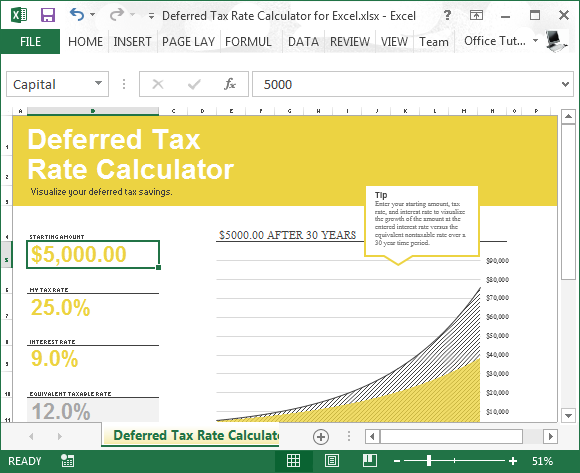

Deferred Tax Rate Calculator For Excel

How Do Work Changes Affect Tax Credits Low Incomes Tax Reform Group

Extension Of 500 Payment For Working Households On Tax Credits Low Incomes Tax Reform Group

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Deferral How Will It Affect You Experian

15 May Deadline For Covid 19 Tax Deferral Kpmg Malta

How To Apply Online For The Vat Deferral Payment Scheme 2021 And Defer Vat Payments

How To Pay Vat Deferred Due To Covid 19

Vat Deferral New Payment Scheme Online Service Opens Revel

Corporate Employer Tax Reporting Of Share Option And Loan Note Transactions By 6 July 2020 Note As At 4 May 2020 No Hmrc Announcement Of Any Covid Deferral Of The Filing Deadline

Understanding The Skip A Payment And Mortgage Deferral Option Investadisor Mortgage Payment Budgeting Money Mutual Funds Investing

Tax And Companies House Deferrals Accountants Thetford Bury St Edmunds Knights Lowe

/income-tax-4097292_19201-3af2a17857e34c5fb24b9986fa3d1991.jpg)

Deferred Tax Liability Definition

Comments

Post a Comment