2021 Standard Deduction And Tax Rates

If your standard deduction is more than the total of your itemized. For example suppose a married couple filing jointly has 70000 in other taxable income after deductions and 20000 in qualified dividends and long-term capital gains in 2022.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

2020 Federal Income Tax Brackets.

2021 standard deduction and tax rates. For tax year 2021 which generally applies to tax returns filed in 2022 the amounts have increased as follows. Get an overview State Income Tax Brackets and Standard Deductions. You can use the mileage tax deduction to offset the cost of using a personal vehicle for business reasons.

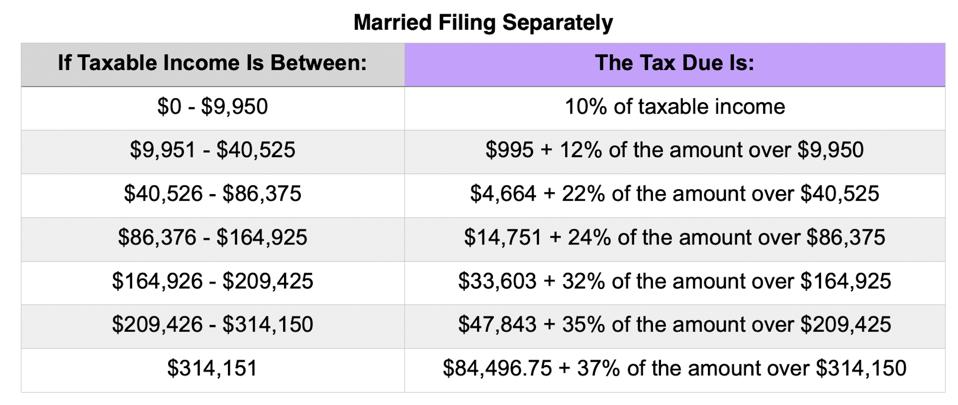

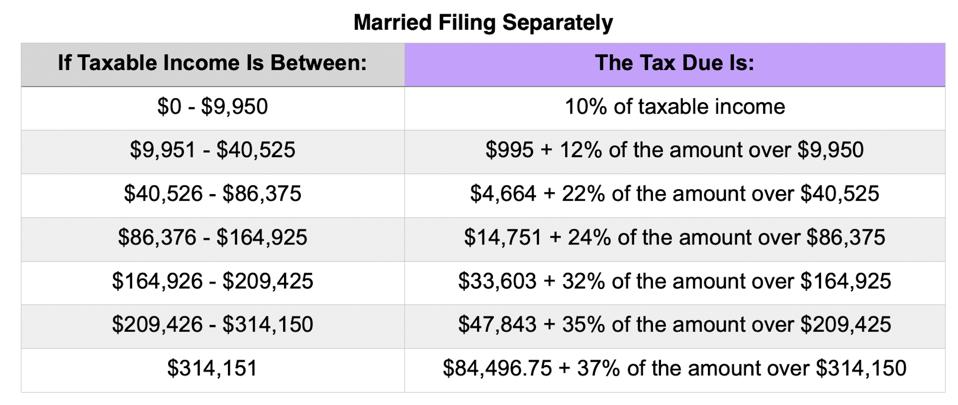

Tax deductions lower your tax burden by lowering your taxable income and you can either claim the standard deduction or itemize your deductions when you file. For example in 2019 you could claim 58 cents per business mile on your. Single taxpayers and married taxpayers who file separate returns.

We will add the 2023 mileage rates when the IRS releases them. This limit includes property and sales tax. In October 2020 the IRS released the new tax brackets for 2021-2022 with modest changes.

IRS Tax Tables Deduction Amounts for Tax Year 2021 This article gives you the tax rates and related numbers that you will need to prepare your 2021 income tax return. 2021 State Income Tax Rates and Brackets. The standard mileage tax rate changes each year.

In general 2021 personal income tax returns are due by April 15 2022. For 2021 the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of 1 1100 or 2 the sum of 350 and the. That means the mileage tax deduction 2021 rate is different from previous years.

The personal exemption for tax year 2021 remains at 0 as it was for 2020. For tax year 2020 for example the standard deduction for those filing as married filing jointly is 24800 up 400 from the prior year. With the Tax Cut Jobs Act tax reform implemented in 2018 the 2021 and 2022 tax brackets tax rates and standard deduction amounts have all been heavily revised from pre-reform levels.

1988 to 2022 This report tracks changes in federal individual income tax brackets the standard deduction and the personal exemption since 1988. The additional standard deduction for people who have reached age 65 or who are blind is 1350 for each married taxpayer or 1700 for unmarried taxpayers. How Federal Tax Brackets Work.

Federal Individual Income Tax Brackets Standard Deduction and Personal Exemption. 2021 California Tax Rates Exemptions and Credits The rate of inflation in California for the period from July 1 2020 through June 30 2021 was 4 4 The 2021 personal income tax brackets are indexed by this amount - 11 - Cˆˇ T ˆ OCTOBR 2021 2021 California Tax Rate Schedules Single or MarriedRDP Filing Separate If the taxable income is Over But not. The standard deduction is adjusted annually for inflation and the limits are based on your filing status.

The rates are categorized into Business Medical or Moving expenses and Service or Charity expenses at a currency rate of cents-per-mile. Single or married filing separately. All three have been indexed for inflation since 1981.

Open this PDF with State related Standard Deductions and Tax Brackets for 2021. If you are single or married filing separately the deduction is 12550. 2018 Federal Tax Rates.

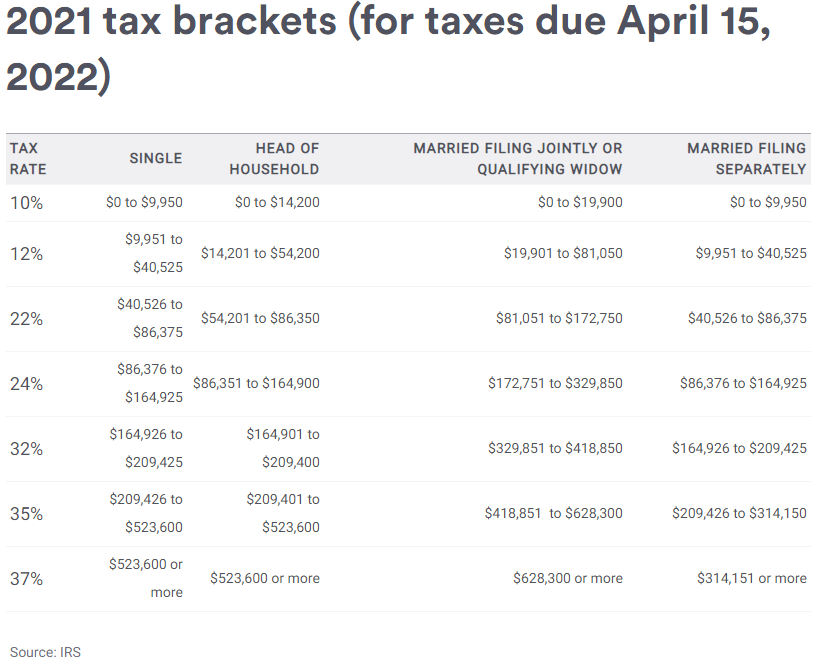

For single taxpayers and married individuals filing separately the standard deduction rises to 12550 for 2021 up 150 and for heads of households the standard deduction will be 18800 for tax year 2021 up 150. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1. Below are the optional standard tax deductible IRS mileage rates for the use of your car van pickup truck or panel truck for Tax Years 2007-2022.

Standard deduction rates are as follows. State Rates Brackets Rates Brackets Single Couple Single Couple Dependent. For 2021 the additional standard deduction amount for the aged or the blind is 1350The additional standard deduction amount increases to.

Note that the updated tax rates and taxable income brackets would only apply for the 2021 tax year filed in 2022. Federal income tax is a progressive tax system. These limits are for taxes due by April 18 2022 or April 19 if you live in Maine or Massachusetts the IRSs extended deadline to file individual tax returns for 2021.

Furthermore when you prepare and e-File. Standard Deduction Amounts The standard deduction amounts will increase to 12550 for individuals and married couples filing separately 18800 for heads of household and 25100 for married couples filing jointly and surviving spouses. Kiddie Tax.

2021 Federal Income Tax Brackets and Rates. Upcoming Tax Brackets Tax Rates for 2021-2022. The sales tax limit for tax year 2021 is 10000 or 5000 if youre married and filing separately.

Begin Your Free E-file Its the easiest and most accurate way. This means that you are taxed at a. For current tax filings covering the 2020 tax year refer to the 2020 tax brackets updatetable below.

If you are married filing jointly or are a qualifying widower the deduction is 25100. Note that the Tax Foundation is a 501c3 educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. It includes factors like gasoline prices wear-and-tear and more.

2021 Tax Brackets IRS Federal Income Tax Rates Table In the tables below it is important to note. Standard Deduction Amounts. 2022 Federal Income Tax Brackets.

Maximum Zero Rate Amount for Qualified Dividends and Long-term Capital Gains. But that deduction applies to. 2019 Federal Income Tax Brackets.

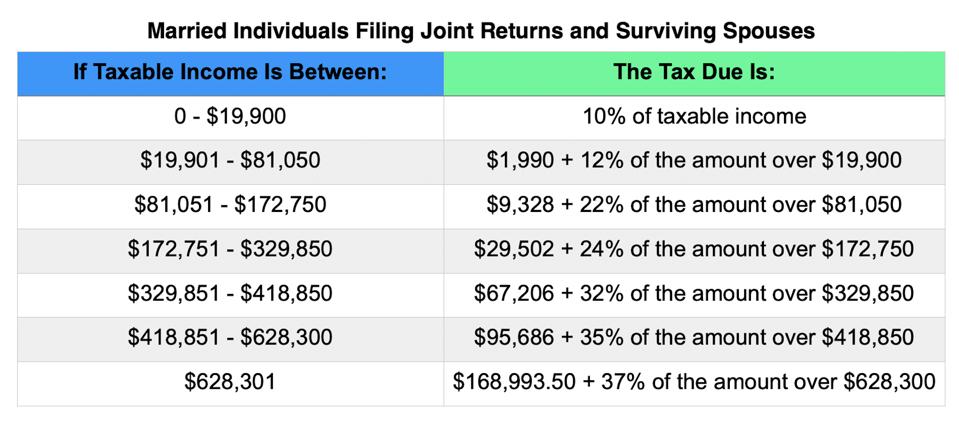

Alabama a b c 200 0. 2021 Federal Taxable Income IRS Tax Brackets and Rates. Tax Rate Single Filers Married Filing Jointly SS Married filing separately Head of Household.

This elimination of the personal exemption was a provision in. For these rates to change Congress would have to vote to change the tax rates. Barring new legislative changes these brackets will continue through 2025.

For tax year 2021 what you file in early 2022 the standard deduction is 12550 for single filers 25100 for joint filers and 18800 for heads of household. 2021 Federal Income Tax Brackets. 12550 for tax year 2021 12950 for tax year 2022 Married taxpayers who file jointly and for qualifying widowers.

For the 2021 tax year the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. How much is the sales tax deduction for tax year 2021. 2021 standard deductions are a bit sweeter The standard deductions for 2021 come with a boost that will lead to more tax savings.

Here is a look at what the brackets and tax rates are for 2021 filing 2022. State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption. The 2021 standard deduction amounts are as follows.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 Taxes For Retirees Explained Cardinal Guide

What Are Marriage Penalties And Bonuses Tax Policy Center

Inkwiry Federal Income Tax Brackets

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

2021 Tax Thresholds Hkp Seattle

Deficit Adjusted Tax Brackets For 2021

2020 2021 Federal Income Tax Brackets

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

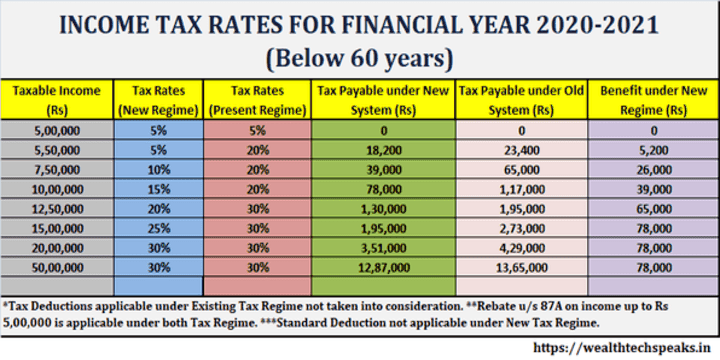

Income Tax Financial Year 2020 2021 Ay 2021 22 Tax Implications Wealthtech Speaks

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2021 Taxes For Retirees Explained Cardinal Guide

2021 Tax Thresholds Hkp Seattle

2021 Tax Brackets Standard Deductions

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs 2021 Tax Tables Deductions Exemptions Purposeful Finance

2022 Tax Inflation Adjustments Released By Irs

2021 Tax Brackets Standard Deductions

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Comments

Post a Comment