2020 Tax Calculator Married Filing Jointly

After May 17 2024 you will no longer be able to claim your 2020 Tax Refund through your Tax Return. If you choose married filing jointly both of you can be held responsible for the tax and any interest or penalty due.

Tax Calculator Estimate Your Income Tax For 2021 And 2022 Free

One important point before we go on is that the tax return youll file during 2020 is for the 2019 tax year while any 2020-specific deduction amounts refer to the tax return youll file in.

2020 tax calculator married filing jointly. Did you know you can only file electronically when you are filing for the current tax year. If you both claim exemptions and married you may end up having too little withheld. Exemption from Withholding.

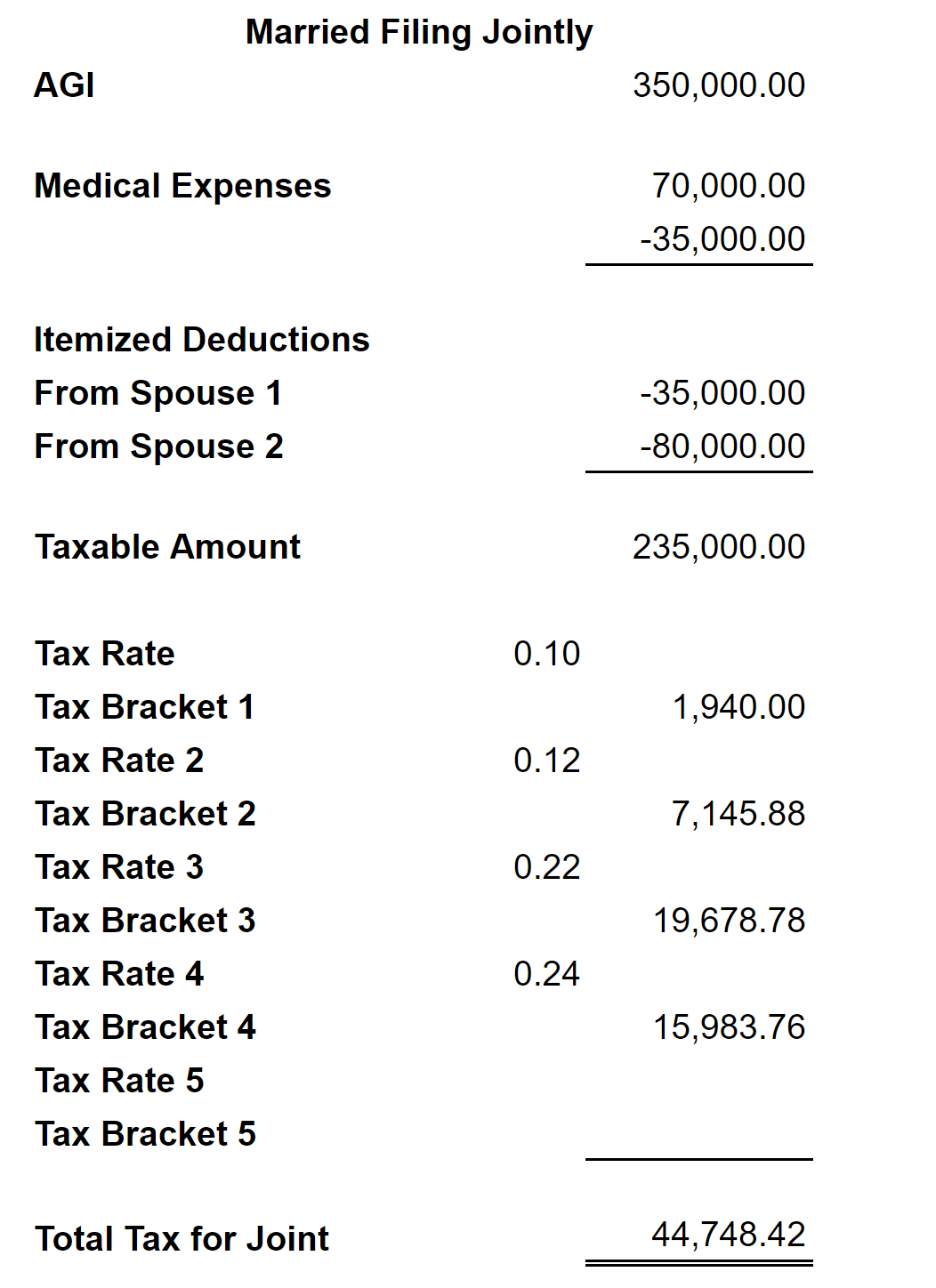

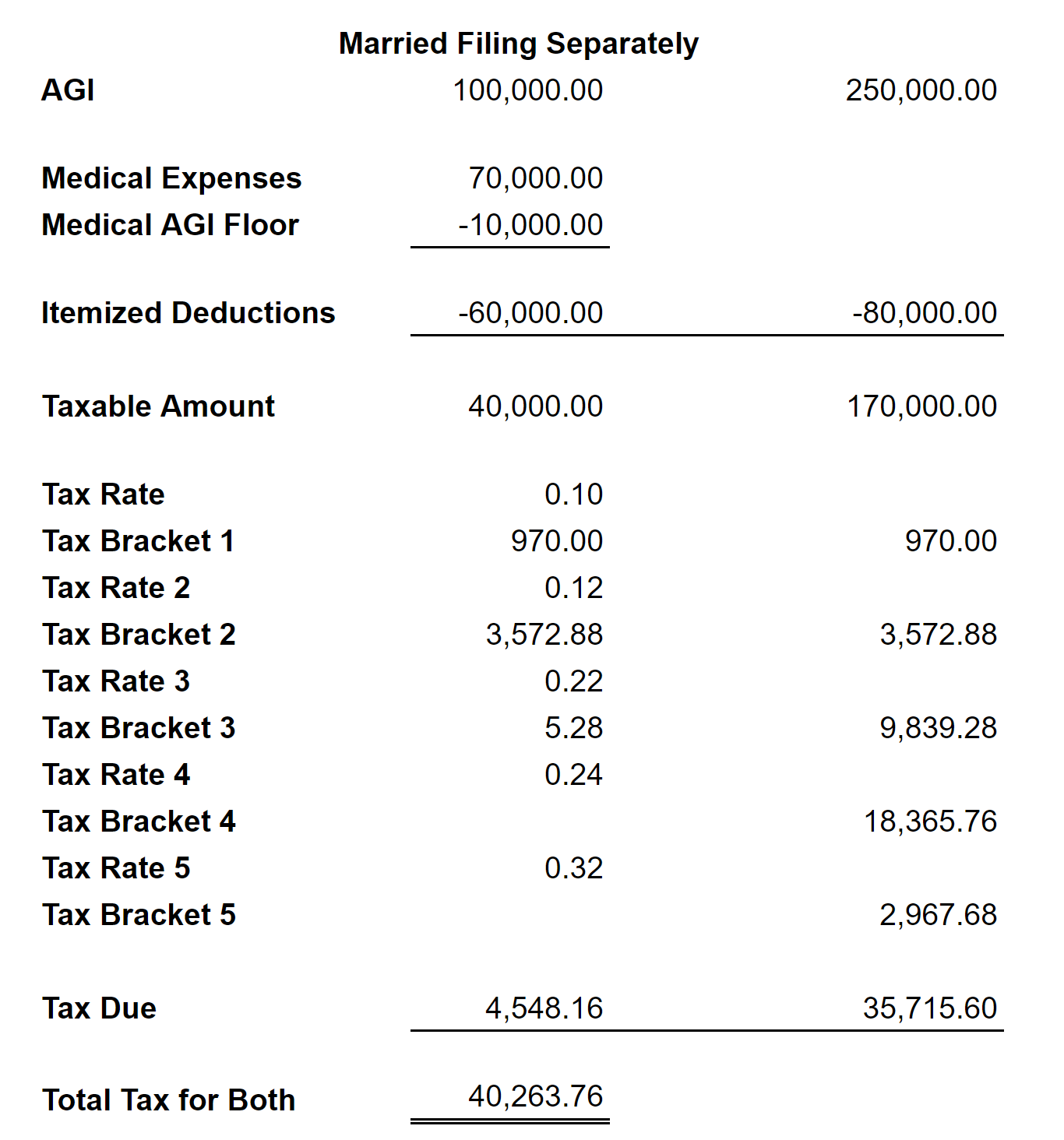

Now lets assume you and your partner are married and use the. For 2020 the limit on deductible charitable contributions has been increased to 100 of your AGI. Mortgage interest and contributions to charity count as deductions.

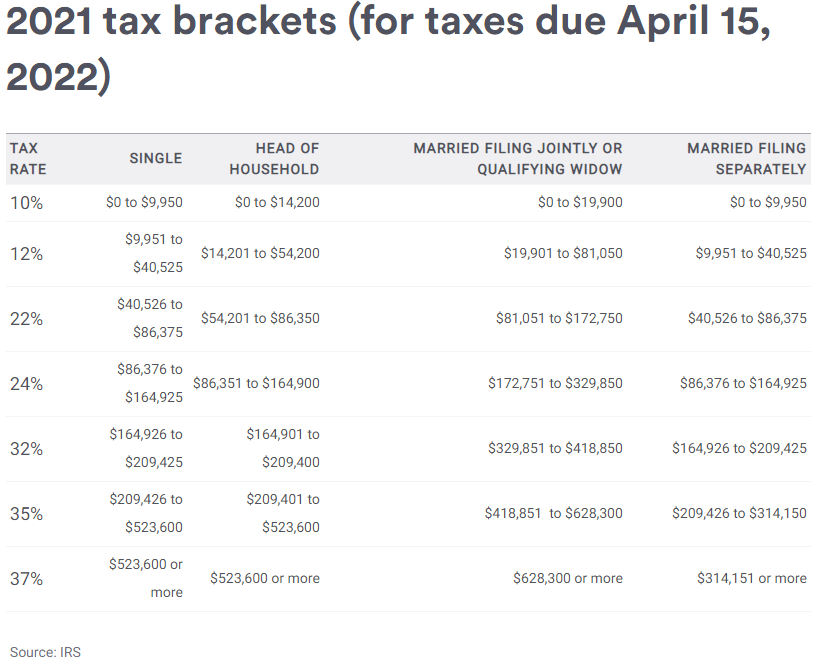

See this Tax Calculator for more The obvious way to lower your tax bill is to increase the untaxed area at the bottom of the diagram. See our present year tax calculators before you eFileIT by April 15 following. For single taxpayers and married individuals filing separately the standard deduction rises to 12400 in for 2020 up 200 and for heads of households the standard deduction will be 18650 for tax year 2020 up 300.

Single California 2EZ Table. MarriedRDP Filing Jointly or Qualifying Widower Joint California 2EZ Table. The best way to figure out whether married filing jointly or married filing separately will benefit you the most is to prepare your returns both ways.

Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Also for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. Go to Other.

Do not include dollar signs commas decimal points or negative amount such as -5000. Then choose the filing status with the lowest net balance due or refund. Ad Easy to use Online Calculator to check Eligibility Refund Amount.

In fact the US. Contributions to deductible retirement accounts count as adjustments. You can use the TurboTax Calculator built into the program that already has all of your information to help you figure out the best way to fill in your W4 so you dont end up owing.

Married people can choose to file their federal income taxes jointly or separately each year. So make sure to file your 2020 Tax Return as soon as possible. Other Income not from jobs Other Deduction.

1993 saw a tax hike on the wealthy via two new brackets at. Filing Status Children under Age 17 qualify for child tax credit Other Dependents. Form 540 and 540 NR.

For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing. Check if you have multiple jobs. The standard deduction for married filing jointly rises to 24800 for tax year 2020 up 400 from the prior year.

Choose Tax Year and State. The personal exemption for tax. While filing jointly is usually more beneficial its best to figure the tax both ways to find out which works best.

Remember if a couple is married as of December 31 the law says theyre married for the whole year for tax purposes. Tax code often favors married couples who file jointly. Youll each be in the 35 tax bracket.

Dont Overpay your Taxes Claim Back Today. To access this calculator click on. Tax Hikes Tax Cuts.

Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. Many of these benefits are also available even if one spouse doesnt work or has little to no income. They have access to more tax breaks than couples filing separately higher income limits for many credits and deductions and higher income brackets for lower tax rates.

Head of household 2020. Tax Year for Federal W-4 Information. You each use the single tax filing status.

This calculator does not figure tax for Form 540 2EZ.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Us Child Tax Credit Refund Calculator Expat Tax Online

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

2020 2021 Federal Income Tax Brackets

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Can A Married Person File Taxes Without Their Spouse

:max_bytes(150000):strip_icc()/standard-deduction-3193021-FINAL-2020121-92f98d614dad4d72b36e54b867362f18.png)

The Ultimate Guide To Doing Your Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

What Are Marriage Penalties And Bonuses Tax Policy Center

Can A Married Person File Taxes Without Their Spouse

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Tax Withholding For Pensions And Social Security Sensible Money

The Kiddie Tax Changes Again Putnam Investments

Comments

Post a Comment